arizona estate tax exemption 2019

Suzanne Droubie Pima County Assessor. The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Disabled citizens and veterans could get a 3000 property.

. This Certificate is prescribed by the Department of Revenue pursuant to ARS. Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. Arizona Disability Property Tax Exemption.

The department created exemption certificates to document non-taxable transactions. TPT Exemption Certificate - General. Property 4 days ago Although they are limited property tax exemption programs do exist in Arizona and might be the best option for you or a.

The 2 million estate tax exemption was indexed for inflation annually beginning in 2014. The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Do Seniors Get A Property Tax Break In Arizona. This means that on the federal level if your estate is valued at less than 11580000 when you die then your beneficiaries will not have to pay any federal tax on their inheritance. For tax years prior to 2019 Arizona allowed dependent exemptions for persons that qualify as dependents on a federal tax return.

The 2019 Federal estate tax exemption. The purpose of the Certificate is to. Individuals who do not furnish this information may lose the dependent credit exemption for years prior to 2019.

This establishes a basis for state and city tax deductions or exemptions. In 2019 the Federal Unified Gift and Estate Tax Exemption will increase from. As for the property tax credit individuals may qualify for a credit if they.

The 2019 estate and gift exemption rose 220000 from the 2018 amount of 11180000 to 114 million a nice round number that is easier to remember. Arizona Department of Revenue 602 255-3381 1600 West Monroe Street Phoenix AZ 85007. New Jersey finished phasing out its estate tax last year and now only imposes an inheritance tax.

This amount is then applied to the exemption for the estate tax. Disabled citizens and veterans could get a 3000 property tax exemption given that the assessed value of their property is less than 10000. It is to be filled out.

Delaware repealed its estate tax in 2018. Federal law eliminated the state death tax credit effective January 1 2005. The Internal Revenue Service IRS has announced the estate tax exemption and gift tax exemption amounts for 2019.

Again very few people are assessed the estate tax because most estates are less than 100000. In the Tax Cuts and Jobs Act the. Learn About Property Tax Exemption in Arizona Explained Property 8 days ago Arizona Disability Property Tax Exemption.

An estate tax deduction of up to 25 million was available for certain family-owned. However depending on the size of your estate you may be subject to the federal estate tax. But if you have an.

Starting with the 2019 tax year Arizona allows a dependent. This property tax exemption has been inactive and as County Assessors we have been instructed by the courts to not provide it due.

Gas Tax Rates 2019 2019 State Fuel Excise Taxes Tax Foundation

Do You Report Income Tax On An Inheritance In Arizona Budgeting Money The Nest

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Death And Taxes Nebraska S Inheritance Tax

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Tangible Personal Property State Tangible Personal Property Taxes

Selling A Home Capital Gains Exclusion Phoenix Tucson Az

State Death Tax Hikes Loom Where Not To Die In 2021

A Guide To The Federal Estate Tax For 2022 And 2023 Smartasset

Nj Division Of Taxation Inheritance And Estate Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Your State Have An Estate Or Inheritance Tax

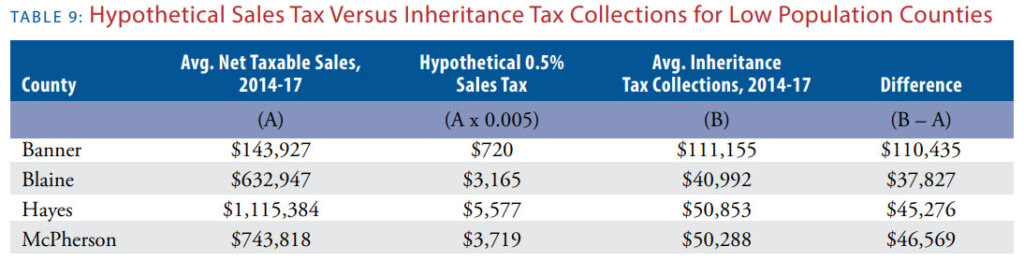

Death And Taxes Nebraska S Inheritance Tax

General Sales Taxes And Gross Receipts Taxes Urban Institute

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die